Asset allocation is a foundational element in the world of investing, shaping the path towards achieving financial goals. We at nasdaqpicks understand its critical role and how it influences investment performance.

In this post, we’ll explore the best practices in asset allocation, outlining strategies to maximize returns while managing risk. Join us as we navigate through the essentials of crafting a well-balanced investment portfolio.

Why Asset Allocation Matters

Asset allocation isn’t just a buzzword in the investment world; it’s the cornerstone of successful portfolio management. The principle is straightforward: don’t put all your eggs in one basket. However, the execution requires a nuanced understanding of what makes up an investment portfolio and how different assets interact to impact overall performance.

At its core, asset allocation is about balance. It involves distributing your investment across various asset classes—stocks, bonds, and cash being the primary categories. Each of these has different levels of risk and potential return, meaning your portfolio’s makeup directly influences your financial outcome. For example, stocks offer higher potential returns but come with increased volatility. In contrast, bonds generally provide more stable but lower returns. Cash, or cash equivalents, offer the least risk but also the lowest potential for growth.

But why does this balance matter so much? Because it directly affects your investment performance. A well-allocated portfolio can smooth out the bumps on the financial market’s road, reducing the impact of a downturn in any single asset class on your overall holdings. In other words, it’s your best defense against market volatility.

Here are some practical tips on how to approach asset allocation:

-

Start with Your Goals: Identify your financial goals, risk tolerance, and investment timeline. These will guide how you allocate your assets. For instance, if you’re saving for retirement 30 years down the line, you might lean more heavily towards stocks.

-

Review Regularly: The market changes and so do your personal circumstances. Regularly reviewing and adjusting your portfolio ensures it remains aligned with your goals.

-

Diversify Within Asset Classes: It’s not enough to simply spread your investments across stocks, bonds, and cash. Look within these categories to diversify further—for example, consider a mix of domestic and international stocks.

-

Use Tools and Resources: Many online tools can help with asset allocation. Consider checking out our posts on strategies for portfolio diversification and evaluating investment performance for more in-depth guidance.

In conclusion, understanding and implementing effective asset allocation strategies is not just beneficial; it’s essential for any investor looking to achieve long-term financial goals. By spreading your investments across various asset classes, you can mitigate risk and position your portfolio for growth, regardless of individual market movements. Remember, the key to successful investing isn’t predicting the future; it’s preparing for it by building a resilient portfolio.

Crafting a Balanced Portfolio

Navigating the complexities of asset allocation can seem daunting, yet it stands as the bedrock of a successful investment strategy. The key lies in striking a balance that aligns with your financial objectives while cushioning against market volatility. Let’s delve into actionable approaches for creating a well-rounded investment portfolio.

Diversification Is Your Safeguard: The adage of not putting all your eggs in one basket holds true. Diversification minimizes your risk by spreading investments across a variety of asset classes. This doesn’t mean a superficial mix but a deep dive into the layers within each class. Equities, for instance, should blend a variety of sectors, geographical regions, and company sizes. A blend of both high-risk and safer bonds can balance the scales further.

Stay on Top of Your Portfolio: A static investment strategy is a recipe for underperformance. The markets evolve, and so should your portfolio. An annual or bi-annual review ensures your investments remain in line with your goals. Adjustments may be needed due to life changes, economic shifts, or performance drifts. Tools like portfolio analyzers can provide insights into your asset distribution and help identify areas for reallocation.

Matching Portfolio with Life’s Timeline: Your investment strategy should morph with your life’s stages. Younger investors often have the luxury to take on more risk with a heavier stock allocation, eyeing long-term growth. As retirement nears, shifting towards bonds and cash equivalents can provide stability and protect against market downturns. Understanding this dynamic is critical in planning for the future.

Embrace Risk, Prudently: Risk tolerance is deeply personal and varies significantly across individuals. Acknowledging your comfort level with volatility guides your asset allocation decisions. High-risk investments can offer substantial returns, but the possibility of severe losses is real. Balancing risk and potential reward is fundamental to crafting a portfolio that can weather the storms.

-

Quick Tips:

-

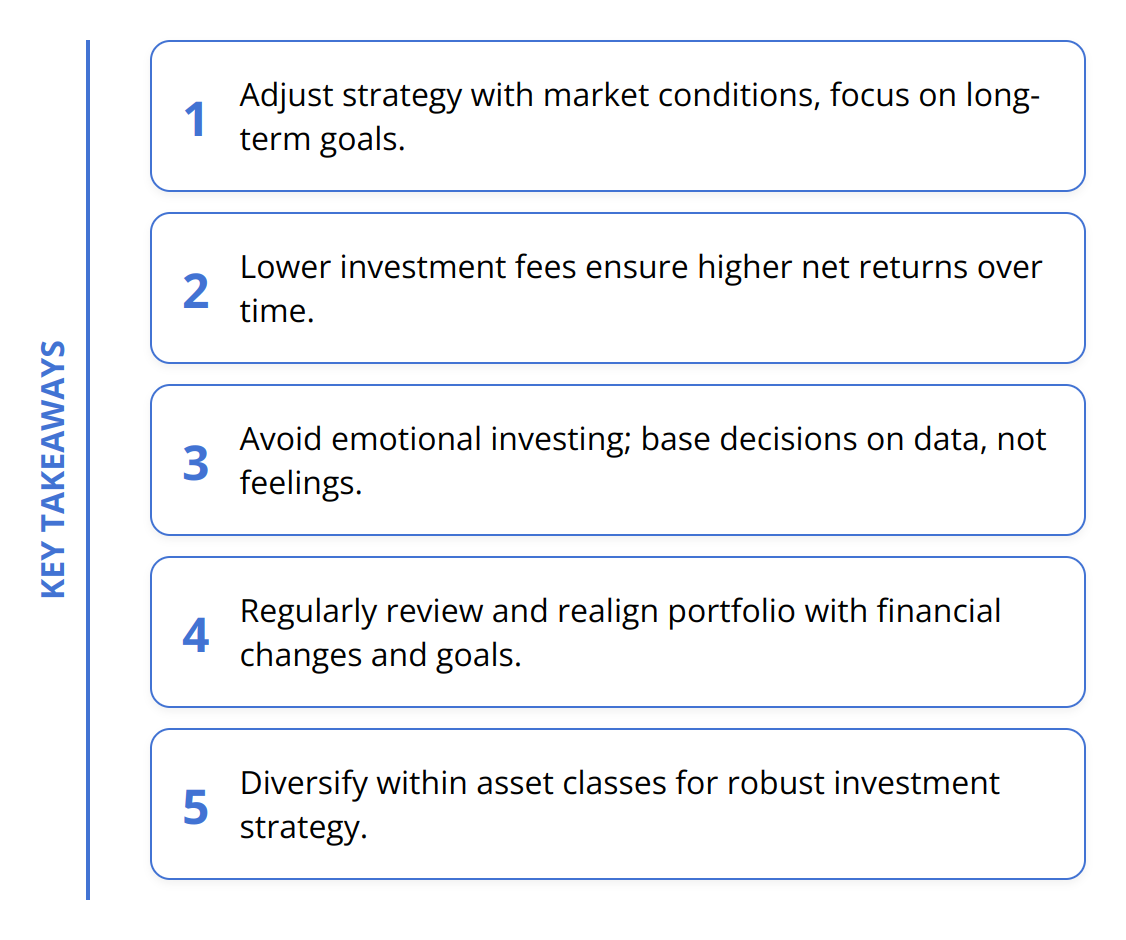

Regularly assess and adjust your investments to changes in the market and your life.

-

Utilize online tools for comprehensive analysis and rebalancing suggestions.

-

Diversify within asset classes for a robust investment strategy.

By adhering to these principles, investors can construct a portfolio that not only aligns with their financial aspirations but also provides a buffer against the unpredictability of the markets. An informed approach to asset allocation fosters a resilient investment strategy poised for long-term success.

Avoiding Asset Allocation Errors

Asset allocation is the blueprint for building a sustainable investment portfolio. However, certain pitfalls can undermine its efficiency, eventually leading to disappointing results. By recognizing and avoiding these common mistakes, you can significantly influence your investment outcomes positively.

Ignoring Current Market Trends

One of the major oversights is disregarding the current market environment. While long-term strategies are fundamental, being attuned to the market’s pulse is equally important. For instance, during a bull market, reallocating some funds from bonds to stocks might enhance your portfolio’s growth potential. Conversely, in a bear market, increasing your allocation in bonds or other safer assets can shield your investments from excessive volatility. Always stay informed and be ready to make calculated adjustments. Adequate research and data analysis can lead to informed decisions that align with both current trends and long-term goals. For insights on market trends, reading up on market analysis can provide valuable information.

Overlooking Costs and Fees

Costs and fees can eat into your returns like nothing else. Many investors overlook this aspect, focusing solely on gross returns rather than what they actually take home. It’s vital to understand that even a 1% difference in fees can result in a significant impact on your portfolio over time. Opt for investments with lower expense ratios and be wary of transaction costs. Using index funds or ETFs can be a smart way to keep fees to a minimum while maintaining desired exposure to various asset classes.

Giving Into Emotions

Investing is fraught with highs and lows, and it’s easy for emotions to take the driver’s seat. However, making investment decisions based on fear or greed can derail your asset allocation strategy. Panic selling during downturns or greedily chasing high returns without regard to risk can lead to significant losses. Discipline is key. Stick to your strategy and adjust only based on rational analysis and changes in your financial goals, not on market euphoria or doom.

Key Takeaways:

-

Be aware of market conditions and adjust your strategy accordingly but remain focused on long-term goals.

-

Costs matter. Lower fees translate to higher net returns over time.

-

Emotional investing is detrimental. Decisions should be based on data, not feelings.

By sidestepping these common mistakes, you set the stage for a more resilient and effective investment portfolio. Asset allocation is not a set-and-forget strategy. It requires vigilance, adaptability, and a clear understanding of one’s goals and risk tolerance. Effective asset allocation is a dynamic process, and steering clear of these pitfalls is crucial in navigating the path to financial success.

Final Thoughts

In wrapping up, it’s clear that asset allocation plays a pivotal role in investment strategy, acting as the compass guiding investors through the volatile seas of the market. Our journey through best practices has underscored the importance of a balanced, diversified portfolio tailored to individual financial goals, risk tolerance, and investment timelines.

Effective asset allocation is marked by a series of strategic decisions—diversifying within asset classes, regularly reviewing and adjusting the portfolio, and staying abreast of market trends to make informed adjustments. Tools and resources, like those we provide at nasdaqpicks, are invaluable for staying informed about the financial world, ensuring that your asset allocation strategies are both robust and responsive.

Maintaining discipline and consistency is indispensable. While the temptation to react to short-term market fluctuations can be strong, a disciplined approach, focusing on long-term objectives, is what separates successful investors from the rest. This involves a steadfast adherence to your investment plan, with adjustments made not out of fear or greed, but as a logical response to personal financial changes or shifts in the broader economic landscape.

Looking forward, it’s evident that asset allocation will continue to evolve, influenced by global economic trends, technological advancements, and changing investor needs. However, the fundamentals of creating a balanced, diversified portfolio that aligns with individual goals and risk tolerances will remain constant. Investors who embrace these principles will be well-equipped to navigate future market cycles and achieve their financial objectives.

In a world where the only constant is change, staying informed and adaptable is key. We at nasdaqpicks are committed to keeping you ahead of the curve with timely news, updates, and analyses. By leveraging our insights, you’re not just preparing for the future; you’re shaping it.

Asset allocation is a journey, not a destination. As you continue to navigate your unique financial path, remember: the blend of discipline, consistency, and informed decision-making is the cornerstone of a successful investment strategy.