Understanding stock market anomalies offers traders a critical edge in a highly competitive environment. At nasdaqpicks, we’re committed to equipping our readers with the insights needed to navigate these complexities effectively.

Through this post, we will explore not just what these anomalies are but also how they can significantly impact trading and investment decisions. Join us as we unveil the tools and strategies to turn anomalies into opportunities for your portfolio.

What Are Stock Market Anomalies?

Stock market anomalies are deviations from the common market efficiency theory, suggesting that stocks always reflect all available information. These anomalies provide rare but potential opportunities for investors to achieve higher than average returns. The existence of these anomalies is a reminder that the stock market is not entirely predictable and that there are strategies that can be leveraged for gain.

One well-known anomaly is the January Effect, where stocks, particularly those of small-cap companies, tend to show higher returns in January more than any other month. This trend has been linked to tax-loss selling in December, leading to an increase in demand and, consequently, prices in January. Another notable anomaly is the Day of the Week Effect, suggesting that stocks perform better on certain days of the week. Historically, Fridays have shown better average returns when compared to other weekdays.

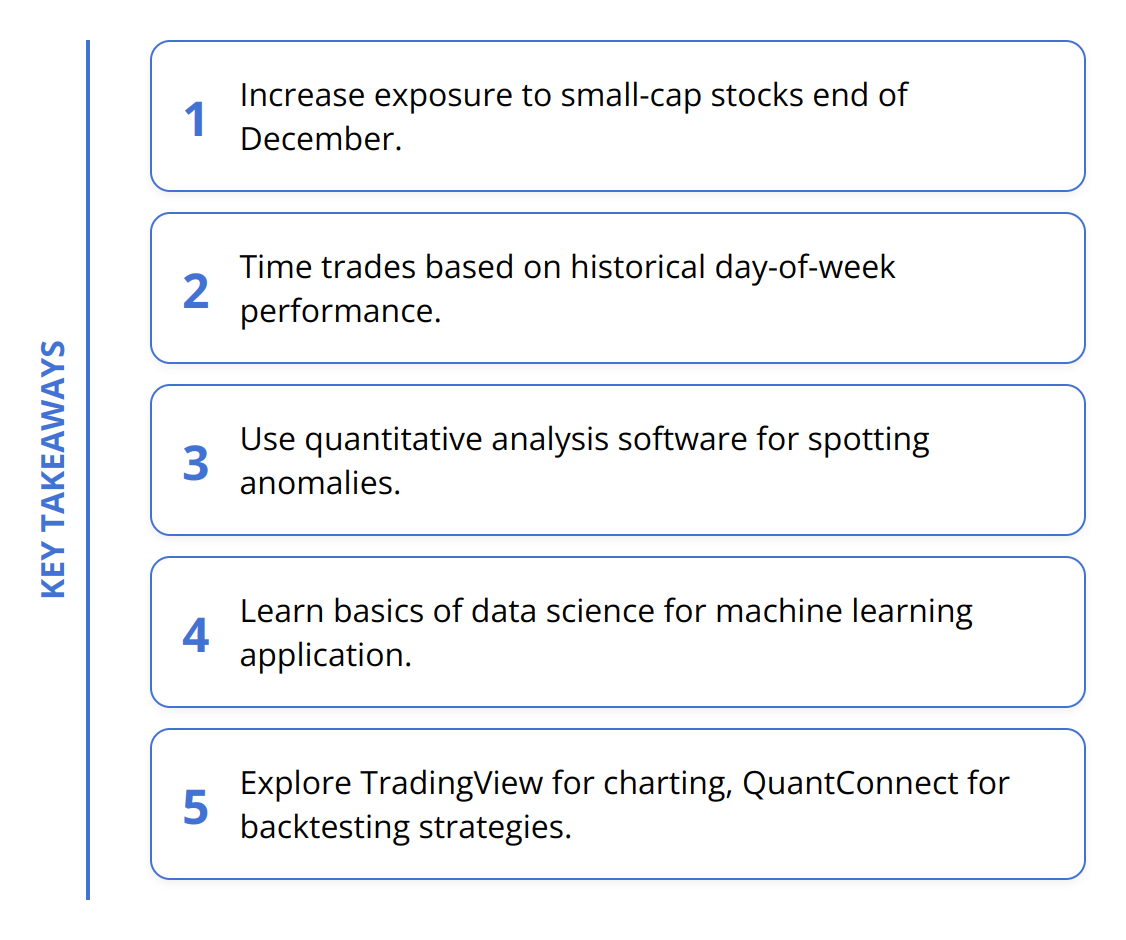

Regarding the practical implications of these anomalies, investors can adjust their strategies to potentially capitalize on these patterns. For example, by increasing exposure to small-cap stocks at the end of December, investors might benefit from the January effect. Similarly, timing trades based on historical performance data of specific days might offer incremental gains.

However, it’s important to act with caution. Not all anomalies persist indefinitely, and market conditions can change, rendering past anomalies obsolete. Here are some actionable tips for investors looking to leverage stock market anomalies:

-

Diversify: Don’t rely solely on anomalies. Make them a part of a diverse investment strategy.

-

Research and Verify: Always check the latest data and research to confirm that an anomaly still holds.

-

Timing is Key: Be mindful of the timing when exploiting anomalies. Historical patterns can offer guidance but are not guarantees.

-

Understand the Risks: Every investment strategy carries risk, and strategies based on anomalies are no exception.

For those interested in the January Effect, a deeper look into past performances and strategies can be found in our January effect analysis. Additionally, understanding how anomalies play into larger market trends can enhance investment decisions, as discussed in our article on market trends.

Ultimately, while stock market anomalies represent a deviation from the norm, offering potential opportunities for higher returns, they should be approached with thorough research and caution. Properly leveraged, they can indeed become a valuable component of an investor’s strategy.

Leveraging Anomalies for Strategy

Understanding the impact of stock market anomalies is vital for traders and investors aiming for above-average returns. Anomalies influence trading decisions and require adjustments in investment strategies, often leading to innovative approaches to capitalizing on market inefficiencies.

Learning from Anomalies

Anomalies, by their nature, challenge the idea that markets are perfectly efficient. They signal areas where information may not be fully reflected in stock prices, offering astute investors a chance to profit. For instance, studying the January Effect can encourage investors to buy small-cap stocks in late December, expecting a price rise in January. This approach, while not foolproof, underscores the value of seasonality in investment decisions.

Adjusting Strategies

Incorporating anomalies into investment strategies involves timing, research, and risk management. For example, the Day of the Week Effect suggests that stocks might perform better on certain days. Traders can use this insight to time their buy and sell orders to capture incremental gains. The key is to remain adaptive and responsive to changing market conditions, as what worked in the past may not always work in the future. Here are some tips for navigating anomalies:

-

Stay informed on current market trends through reliable sources like the market trends article.

-

Balance anomaly-based strategies with other investing principles to mitigate risks.

-

Analyze historical performance but be ready to pivot if the pattern changes.

Practical Case Studies

Several investors have successfully leveraged anomalies for profit. One notable example is Warren Buffett, who often invests in undervalued companies, capitalizing on the neglected firm effect. These companies tend to be overlooked by the market, creating opportunities for higher returns once their true value is recognized.

Another example revolves around the momentum anomaly. Studies have shown that stocks with high past returns, over periods like 3 to 12 months, tend to outperform in the near future. Investors using momentum strategies often achieve significant gains by riding the wave of these trends before they dissipate.

In summary, while stock market anomalies present a unique opportunity for outperformance, they require careful strategy, timing, and risk management. Investors should use anomalies as one of many tools in their investing arsenal, always bearing in mind that markets evolve and what constitutes an anomaly today might become tomorrow’s norm.

Harnessing Tech for Anomaly Insights

In the digital age, technology plays an indispensable role in identifying and exploiting stock market anomalies. Advancements in software, machine learning, and artificial intelligence (AI) have revolutionized the way traders spot irregularities and capitalize on them. Here, we’ll dissect how modern technologies are shaping the future of trading by offering practical tools and insights for detecting anomalies.

The Power of Specialized Software

Modern trading is unimaginable without the software designed to sift through mountains of data to spot potential anomalies. These tools can scan global markets in real-time, identifying patterns that would take humans hours, if not days, to detect. Quantitative analysis software and charting applications are particularly effective in this regard. They offer traders customizable indicators and the ability to test strategies against historical data. Investors keen on integrating technology into their strategy should explore platforms like TradingView for charting and QuantConnect for backtesting strategies.

Machine Learning: A Game-Changer

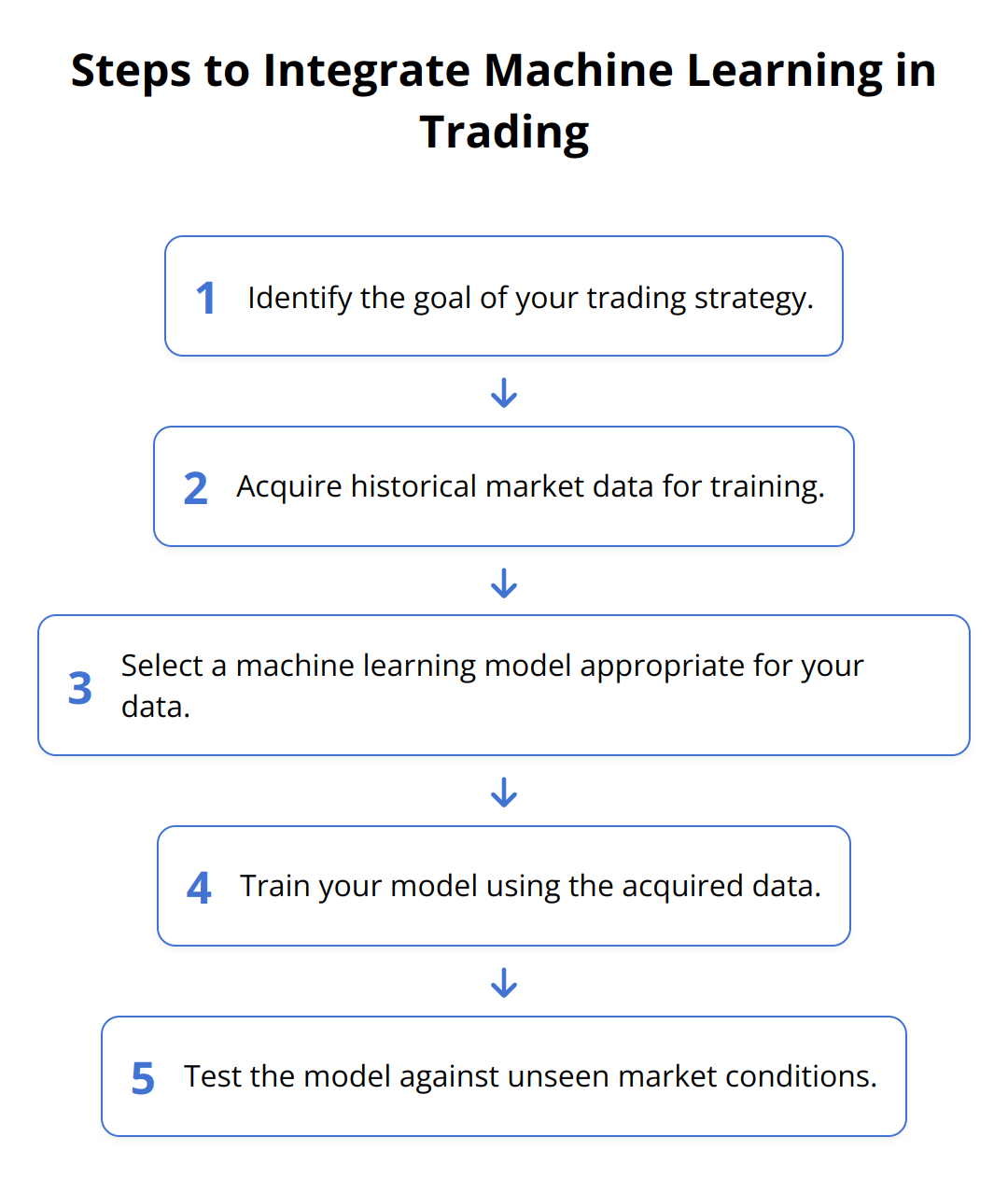

Machine learning, a subset of AI, has significantly enhanced the predictability of market movements by learning from historical data. Algorithms can now recognize complex patterns and anomalies that elude even the most experienced traders. By training models on decades of market data, including price movements and trading volumes, traders can predict potential market shifts with greater accuracy.

Adopting machine learning requires a blend of financial expertise and technical know-how. Those interested should focus on understanding the basics of data science in finance. Online courses from platforms like Coursera or edX can serve as valuable resources for acquiring this knowledge.

The Future of Tech in Trading

Technological advancement doesn’t stand still, and the future of trading technology is poised for further innovation. We’re already seeing the emergence of deep learning—a more advanced form of machine learning—tailored specifically for predicting stock prices with unprecedented precision. Additionally, blockchain technology is beginning to play a role in improving market transparency and reducing fraud, potentially leveling the playing field for all market participants.

The integration of AI with natural language processing (NLP) tools is another frontier. NLP can analyze news articles, social media, and financial reports in real-time, offering traders insights into market sentiment and potential anomaly triggers before they become apparent through traditional analysis.

In conclusion, leveraging technology to detect and exploit stock market anomalies is not only wise but necessary for those looking to maintain a competitive edge. The key lies in staying informed on the latest technological trends and being willing to adapt one’s strategies accordingly. For enthusiasts wanting to dive deeper into how AI and machine learning are transforming trading, consulting relevant resources like the market trends analysis can offer further insights.

By embracing the tools and techniques mentioned, traders can enhance their ability to spot and act on market anomalies, potentially leading to more informed investment decisions and superior returns.

Wrapping Up

Exploring stock market anomalies reveals a complex yet fascinating aspect of the financial world. These deviations from market efficiency theory show that the market is not always predictable, offering savvy investors opportunities for above-average returns. The January Effect and the Day of the Week Effect are prime examples of how understanding these patterns can lead to informed investment strategies.

However, exploiting these anomalies is not without its challenges. The landscape of the stock market is ever-changing, making continuous monitoring and adaptation a necessity for success. Additionally, the role of modern technology, especially advancements in AI and machine learning, cannot be overstated. They provide powerful tools for identifying and capitalizing on these opportunities more efficiently.

The importance of diverse strategies, thorough research, and awareness of the risks involved with anomaly-based trading is paramount. As such, investors should see anomalies as a supplement to their broader investment strategy, not a standalone path to success.

We also emphasize the need for ongoing education and adaptation to changing market conditions. The financial world is dynamic, with new trends and technologies emerging regularly. Keeping abreast of these developments is key to maintaining a competitive edge.

For those interested in further exploration of stock market anomalies and staying updated with the latest in financial news and trends, we highly recommend visiting nasdaqpicks. Our service provides timely news, updates, and insightful analyses designed to keep you informed and ahead in your investment journey.

In summary, stock market anomalies offer intriguing opportunities for investors. By understanding these phenomena, continuously monitoring the market, and leveraging the latest technologies, investors can not only navigate but thrive in the complexities of the financial markets. Engage with resources that elevate your knowledge and strategies, and remain adaptable to shift your approach as the market evolves.